2017 Second Quarter Perspective

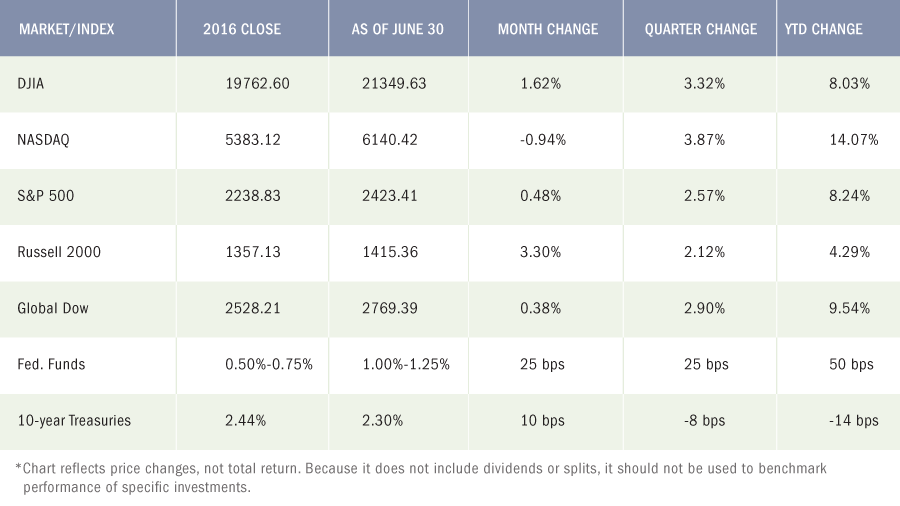

The second quarter proved to be a bit bumpy for equities but regardless, each of the benchmarks listed below finished the quarter ahead of their first-quarter closing values. April saw equities end the month ahead of March, buoyed by favorable corporate earnings reports, proposed tax cuts, and strong foreign economic advances. During the month, the Nasdaq led the way posting monthly gains of 2.30%, followed by the Global Dow, which gained almost 1.50%. The large-cap Dow advanced 1.34%, ahead of the S&P 500, which increased close to 1.00% for the month. Even the small-cap Russell 2000, which has had some rough weeks, closed April 1.05% ahead of its March close.

May was a slower month as consumer spending and wage growth were relatively weak, with only 138,000 new jobs added in May, compared with an average monthly gain of 181,000 over the prior 12 months. Nevertheless, only the Russell 2000 lost value, falling 2.16% from its April closing mark. Nasdaq continued to surge, ending May with a monthly gain of 2.50%.

The second quarter proved to be a bit bumpy for equities but regardless, each of the benchmarks listed below closed the quarter ahead of their first-quarter closing values.

John L Diaz, CFP® / President & Senior Wealth Strategist

Our Thoughts on the Current Economic & Market Environment

US Equity Markets. It’s hard to argue with the fact that equity markets have been extraordinarily resilient in 2017. There have been many headlines and events that could have sparked a broad selloff that would last more than a day. What we have witnessed instead has been plenty of buyers emerge whenever a selloff begins and it has primarily been internal rotations of funds out of one market sector into another. Given the extent of the gains we have witnessed (especially in the technology sector), we do still believe that it would be healthy for the markets if we had a slight pullback or correction. With the Summer now upon us which usually means less volume, volatility could spike.

We have always been big believers that economic and corporate fundamentals will always rule the day. To that end, corporate earnings momentum seems intact and indications suggest that the economic expansion has deepened globally and is now more synchronized. There is now participation of nearly every major world economy and the data includes: improving labor markets, accommodative monetary policies, supportive financial conditions, favorable investor sentiment, and the potential for additional fiscal stimulus. All of this suggests that barring any unforeseen major event, the global expansion should persist and in our opinion, equity markets around the globe could continue on their strong path.

However, this is not to say that a correction could still not take place. Complacency is never a good thing and we are therefore taking a cautious approach with an eye towards taking profits when we see overvaluations, maintaining diversification, hedging and protecting our client assets.

International Markets. With global growth expectations on the rise, we see room for more upside surprises in the ongoing global recovery that is continuing to improve corporate earnings abroad. The strong prospects for earnings growth, combined with reasonable valuations overseas, makes international equities appealing to us. Think “Global”!

Fixed Income. Resiliency can also be used when discussing the state of the fixed income markets. While we did see rates drop earlier in the quarter as measured

As always, we at Premier Wealth Advisors are here to assist you and answer any questions you may have.

Monthly Economic News

Employment

May’s employment report showed unexpected weakness in the labor sector with 138,000 new jobs added in the month, on the heels of 174,000 new jobs added in April, revised. April and March were revised downward to a combined 66,000, which, when coupled with the average gain of 181,000 over the prior 12 months, clearly shows that job growth is slowing. For May, job gains occurred in health care, mining, and professional and business services. The unemployment rate dipped to 4.3% — down from 4.4% in April. There were 6.9 million unemployed persons in May. The labor participation rate inched down 0.2 percentage point to 62.7%. The average workweek was unchanged at 34.4 hours. Average hourly earnings increased by $0.04 to $26.22. Over the last 12 months ended in May, average hourly earnings have risen by $0.63, or 2.5%.

FOMC / interest rates

Following its meeting in June, the Federal Open Market Committee raised the target range for the federal funds rate by 25 basis points to 1.00%-1.25%. This is the second interest rate hike in 2017, with the first coming in March. In support of its decision to raise interest rates, the Committee observed that economic activity has been rising moderately so far in 2017, business spending has continued to expand, and, while job gains have moderated, the unemployment rate has declined. Noting that inflation has slowed in the short term, the Committee expects inflation to stabilize around 2.0% over the medium term.

Key Dates / Data Releases

7/3: PMI Manufacturing Index, ISM Manufacturing Index

7/6: International trade

7/7: Employment situation

7/11: JOLTS

7/13: Producer Price Index, Treasury budget

7/14: Consumer Price Index, retail sales, industrial production

7/18: Import and export prices

7/19: Housing starts

7/24: Existing home sales

7/26: New home sales, FOMC meeting

7/27: International trade in goods, durable goods orders

7/28: GDP

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. Market indices listed are unmanaged and are not available for direct investment.

All third-party materials are the responsibility of their respective authors, creators, and/or owners. First Allied is not responsible for third-party materials, and the information reflects the opinion of its authors, creators, and/or owners at the time of its issuance, which opinions and information are subject to change at any time without notice and without obligation of notification.

These materials were obtained from sources believed to be reliable and presented in good faith, nevertheless, First Allied has not independently verified the information contained therein, and does not guarantee its accuracy or completeness.

The information has no regard to the specific investment objectives, financial situation, or particular needs of any specific recipient, and is intended for informational purposes only and does not constitute a recommendation, or an offer, to buy or sell any securities or related financial instruments, nor is it intended to provide tax, legal or investment advice. We recommend that you procure financial and/or tax advice as to the implications (including tax) of investing in any of the companies mentioned.

PREMIER WEALTH ADVISORS

NEW YORK

1411 Broadway, 16th Floor

New York, NY 10018

(800) 499-4143

LONG ISLAND

626 RXR Plaza, 6th Floor

Uniondale, NY 11856

(516) 778-5822

All content on the Premier Wealth Advisors, LLC. websites are provided for informational purposes only and are deemed to be from reliable sources. However, no warranty, expressed or implied, is made regarding its presentation.

This content should not be viewed as a recommendation, offer, or solicitation by PWA to buy, sell, or hold any security or financial product, nor does it endorse any specific investment strategy. Past performance does not guarantee future results, and all investments carry the potential for loss.

PWA manages portfolios based on each client’s specific investment needs, as specified in a signed investment advisory agreement. As a result, each client’s portfolio reflects unique circumstances and investment outcomes. PWA’s outlook and strategies may change based on updated client information, or if material or significant shifts in economic and financial market conditions occur.

While PWA aims to add value in areas beyond investments, such as tax and estate planning, we do not claim to be income tax professionals or estate planning attorneys. You should consult your tax advisor and/or estate planning attorney for legal or accounting needs.

Advisory Services are offered through Premier Wealth Advisors, LLC. an SEC Registered Investment Adviser.