2018 Mid Year Review

As we enter August, we hope you and your family are enjoying a peaceful, relaxing, and happy Summer. Normally, this time of year is the slow season for the markets, but as we have embarked on the second half of 2018, it appears that a new narrative has emerged. Inflation which has been kept in check for years is slowly trending higher, the Fed is in tightening mode and the trade rhetoric between the US, China and the rest of the world is intensifying. In fact, it seems like every day we have a new headline on the trade front that causes a knee jerk reaction in the markets. Just yesterday, the U.S. administration said that President Donald Trump has asked U.S. trade representative to consider imposing additional tariffs on another $200 billion of Chinese goods. China too responded by saying that it is fully prepared to retaliate if the U.S. imposed further tariffs.

Regardless of all this saber rattling, economic growth and corporate earnings across the globe remain strong and although there are some headwinds, we still see steady growth ahead. However, there is no question that uncertainty is starting to creep into forecasts. With the unknown outcome of rising global trade tensions, along with risks of increased inflation and rising interest rates, the wall of worry is getting taller and taller. We do remain optimistic for equity markets but do expect increased volatility as the markets digest developments on these issues.

As a result of the changing market and economic landscape, we are taking a more cautious approach to our portfolio allocations. By no means are we avoiding growth companies, but we are also looking towards “value” and dividend-oriented positions, over-weighting sectors that would be less impacted by potential tariffs, taking profits when opportunities present themselves and increasing cash levels when warranted.

Now is a good time to really take a close look at the current asset allocation of your accounts to ensure that they are aligned with your investment time frame, liquidity needs, your goals, long-term objectives, and your tolerance for volatility. At PWA, we can help you with a complimentary Risk Analysis Review. We use sophisticated portfolio analytics tools that run stress tests on how a portfolio would have performed under several different economic and market scenarios. The more informed you are about risks and how your investments are positioned, the more you can relax, sleep well, and enjoy the things you love most.

Normally, this time of year is the slow season for the markets, but as we embark on the second half of 2018, it appears that a new narrative has emerged.

John L. Diaz, CFP® / President & Senior Wealth Strategist

July Market Review

Favorable economic indicators and encouraging corporate earnings reports helped propel stocks forward in July. Market growth has come despite trade wars between the United States and other trade partners, particularly China. Earlier in the month, the world’s two largest economies imposed tariffs of $34 billion on each other’s goods. Toward the end of July, there was hope of reopening negotiations between the United States and China in an attempt to diffuse the ongoing trade war. Domestically, the U.S. economy appears to be thriving. Over 210,000 new jobs were added in June, although wages have grown by only 2.7% over the last 12 months. Nevertheless, consumers are making more and spending more, while inflationary pressures on prices for goods and services remain in check.

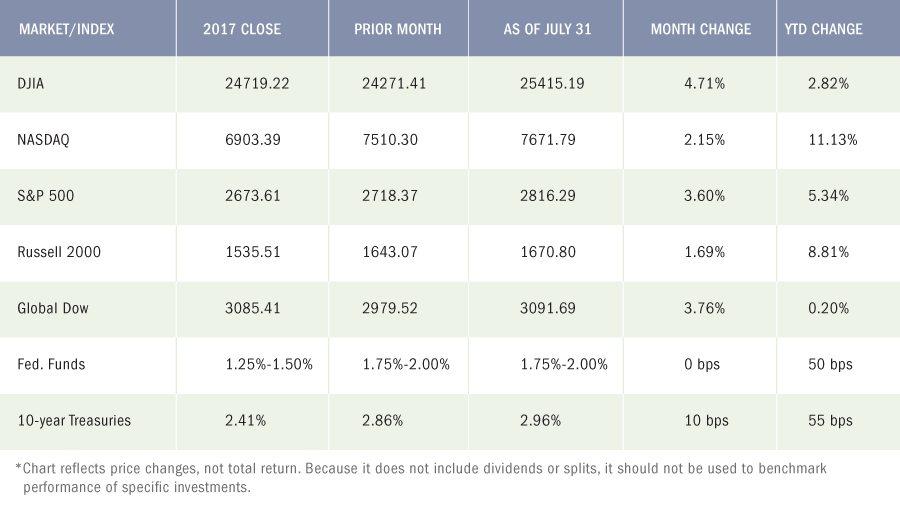

Despite some periods of volatility, July proved to be a very good month for the benchmark indexes listed here. Led by the Dow, large caps, small caps, and tech stocks gained value over their respective June closing prices. Year-to-date, the Nasdaq is ahead by over 11.0%, followed by the Russell 2000, the S&P 500, the Dow, and the Global Dow, which is only 0.20% above its 2017 year-end value.

By the close of trading on July 31, the price of crude oil (WTI) was $68.43 per barrel, down from the June 29 price of $74.25 per barrel. The national average retail regular gasoline price was $2.772 per gallon on July 30, down from the June 25 selling price of $2.833 but $0.305 more than a year ago. The price of gold decreased by the end of July, closing at $1,232.90 on the last trading day of the month, down from its price of $1,254.20 at the end of June.

July’s Economic News

Employment

Total employment rose by 213,000 in June after adding 244,000 (revised) new jobs in May. The average monthly gain over the last three months is 211,000. Total employment has grown by 2.4 million over the last 12 months ended in June. Notable employment gains for the month occurred in professional and business services (50,000), manufacturing (36,000), and health care (25,000). Retail trade, which had posted notable job gains in May, lost 22,000 jobs in June. The unemployment rate rose to 4.0% from 3.8%. The number of unemployed persons increased by 499,000 to 6.6 million. A year earlier, the jobless rate was 4.3% and the number of unemployed persons was 7.0 million. The labor participation rate edged up 0.2 percentage point over the month to 62.9%. The employment-population ratio held at 60.4%. The average workweek was unchanged at 34.5 hours for the month. Average hourly earnings increased by $0.05 to $26.98. Over the last 12 months, average hourly earnings have risen $0.72, or 2.7%.

FOMC / interest rates

The Federal Open Market Committee does not conclude its next meeting until August 1. It is possible that interest rates will remain the same following this meeting. However, unless economic circumstances change dramatically over the next several months, it is likely that rates will be increased twice more before the end of 2018.

GDP/Budget

The second-quarter gross domestic product showed the economy expanded at an annual rate of 4.1%, according to the Bureau of Economic Analysis. The first-quarter GDP grew at an annualized rate of 2.2%. According to the report, consumer spending (personal consumption expenditures) surged, expanding at a rate of 4.0%. Net exports expanded by 9.3%. This is the first, or advance,

Inflation / Consumer Spending

- Consumer spending, as measured by personal consumption expenditures, jumped 0.4% in June after climbing 0.5% (revised) in May. Core consumer prices, a tracker of inflationary trends, increased 0.1% in June. Core prices have

increased 1.9% over the last 12 months. - The Consumer Price Index rose 0.1% in June after increasing 0.2% in May. Over the last 12 months ended in June, consumer prices are up 2.9% — the largest 12-month increase since the period ended February 2012. Core prices, which exclude food and energy, climbed 0.2% for the month, and are up 2.3% for the year.

- The Producer Price Index showed the prices companies receive for goods and services climbed 0.3% following a 0.5% jump in May. Producer prices have

increased 3.4% over the 12 months ended in June, which is the largest 12-month increase since climbing 3.7% in November 2011. Prices less food and energy increased 0.3% for June and are up 2.7% over the last 12 months. Prices for services moved up 0.4% in June.

Housing

Sales of existing homes continued to slow in June. Total existing-home sales fell 0.6% for the month after dropping 0.4% in May. Year-over-year, existing home sales are down 2.2%. The June median price for existing homes was $276,900, which is 5.2% higher than the June 2017 price of $263,300. Inventory for all types of existing homes for sale rose 4.3% in June — 0.5% above a year ago. New home sales regressed in June after climbing 6.7% in May. The median sales price of new houses sold in June was $302,100 ($313,000 in May). The average sales price was $363,300 ($368,500 in May). Inventory rose slightly in June to 5.7 months, up from the 5.2-month supply in May.

Manufacturing

Industrial production advanced 0.6% in June after edging down 0.1% in May. For the second quarter as a whole, industrial production advanced at an annual rate of 6.0% — its third consecutive quarterly increase. Manufacturing output increased 0.8% following a 0.7% drop in May. The index for mining rose 1.2%, its fifth consecutive month of growth. The output of utilities fell 1.5%. Capacity utilization, which estimates the potential for sustainable output for total industrial production, rose 0.3 percentage point for the

Imports and exports

The advance report on international trade in goods revealed that the trade gap expanded by $3.6 billion in June, or 5.5%, over May. The deficit for June was $68.3 billion (the May deficit was $64.8 billion). June exports of goods

International markets

European stocks got a boost from favorable corporate earnings reports and positive rhetoric emanating from a meeting between President Trump and European Commission President Juncker aimed at reducing reciprocal tariffs between the governing bodies. Japan and the European Union agreed to a free-trade pact that is targeted at reducing tariffs on Japanese automobiles and parts and European foods imported by Japan. The Chinese yuan has lost value compared to the dollar. Speculation is that the Chinese government is allowing its currency to weaken, lowering the cost of Chinese exports around the world, which may help offset the effect of U.S. tariffs on Chinese imports. Nevertheless, economic growth in China has slowed as a result of the tariff war with the United States.

Consumer sentiment

Consumer confidence, as measured by The Conference Board Consumer Confidence Index®, gained some positive traction after dipping in June. According to the report, consumers’ confidence in the present economic conditions improved, but expectations for future growth were tempered.

Eye On The Month Ahead

The economy continues to show signs of strengthening despite trade wars, rising interest rates, and a stagnant real estate market. The labor market is expected to maintain its strong pace, while industrial production has been steady. Overall, August should see ongoing economic strengthening.

Key Dates / Data Releases

8/1: FOMC announcement, PMI Manufacturing Index, ISM Manufacturing Index

8/5: Employment situation, international trade

8/7: JOLTS

8/9: Producer Price Index

8/10: Consumer Price Index, Treasury budget

8/14: Import and export prices

8/15: Retail sales, industrial production

8/16: Housing starts

8/22: Existing home sales

8/23: New home sales

8/24: Durable goods orders

8/28: International trade in goods

8/29: GDP

8/30: Personal income and outlays

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. Market indices listed are unmanaged and are not available for direct investment.

All third-party materials are the responsibility of their respective authors, creators, and/or owners. First Allied is not responsible for third-party materials, and the information reflects the opinion of its authors, creators, and/or owners at the time of its issuance, which opinions and information are subject to change at any time without notice and without obligation of notification.

These materials were obtained from sources believed to be reliable and presented in good faith, nevertheless, First Allied has not independently verified the information contained therein, and does not guarantee its accuracy or completeness.

The information has no regard to the specific investment objectives, financial situation, or particular needs of any specific recipient, and is intended for informational purposes only and does not constitute a recommendation, or an offer, to buy or sell any securities or related financial instruments, nor is it intended to provide tax, legal or investment advice. We recommend that you procure financial and/or tax advice as to the implications (including tax) of investing in any of the companies mentioned.

PREMIER WEALTH ADVISORS

NEW YORK

1411 Broadway, 16th Floor

New York, NY 10018

(800) 499-4143

LONG ISLAND

626 RXR Plaza, 6th Floor

Uniondale, NY 11856

(516) 778-5822

All content on the Premier Wealth Advisors, LLC. websites are provided for informational purposes only and are deemed to be from reliable sources. However, no warranty, expressed or implied, is made regarding its presentation.

This content should not be viewed as a recommendation, offer, or solicitation by PWA to buy, sell, or hold any security or financial product, nor does it endorse any specific investment strategy. Past performance does not guarantee future results, and all investments carry the potential for loss.

PWA manages portfolios based on each client’s specific investment needs, as specified in a signed investment advisory agreement. As a result, each client’s portfolio reflects unique circumstances and investment outcomes. PWA’s outlook and strategies may change based on updated client information, or if material or significant shifts in economic and financial market conditions occur.

While PWA aims to add value in areas beyond investments, such as tax and estate planning, we do not claim to be income tax professionals or estate planning attorneys. You should consult your tax advisor and/or estate planning attorney for legal or accounting needs.

Advisory Services are offered through Premier Wealth Advisors, LLC. an SEC Registered Investment Adviser.