Coronavirus—Markets & Economic Impact

We hope you, your family and loved ones are healthy and safe during these unprecedented times. In an age of constant connectivity, no one would have imagined we’d be practicing social distancing and isolation. It’s also hard to imagine that it was only about a month ago that the stock market was at all-time highs, economic growth was on solid footing, and the investment world was enjoying the longest bull market in history.

The Coronavirus/COVID-19 outbreak is first and foremost a human tragedy, and our thoughts and prayers are with those who are ill and suffering. We are humbled and grateful for the courageous nurses, doctors, healthcare workers, and first responders who are on the front lines of this crisis.

The spread of the Coronavirus pandemic has been rapid, and unfortunately, all indications are that we still have more to go before infection rates hit their peak. The virus has created a public health crisis and overwhelmed health care systems in the US and across the globe. To alleviate the pressing medical burden and slow the virus’s spread—or “flatten the curve”—governments around the world have imposed drastic measures such as the closure of non-essential businesses and mass quarantines.

The Economic Fallout

Before the outbreak of this pandemic, the outlook for the U.S. economy remained largely promising. While corporate profit growth was slow in 2019, Wall Street analysts were still anticipating earnings to rise roughly 9% in 2020 on revenue growth of nearly 5%*. Therefore, it wasn’t surprising that up until mid-February, the S&P 500 equity index was up more than 5% for the year, after advancing more than 31% in 2019*. Then suddenly, everything changed.

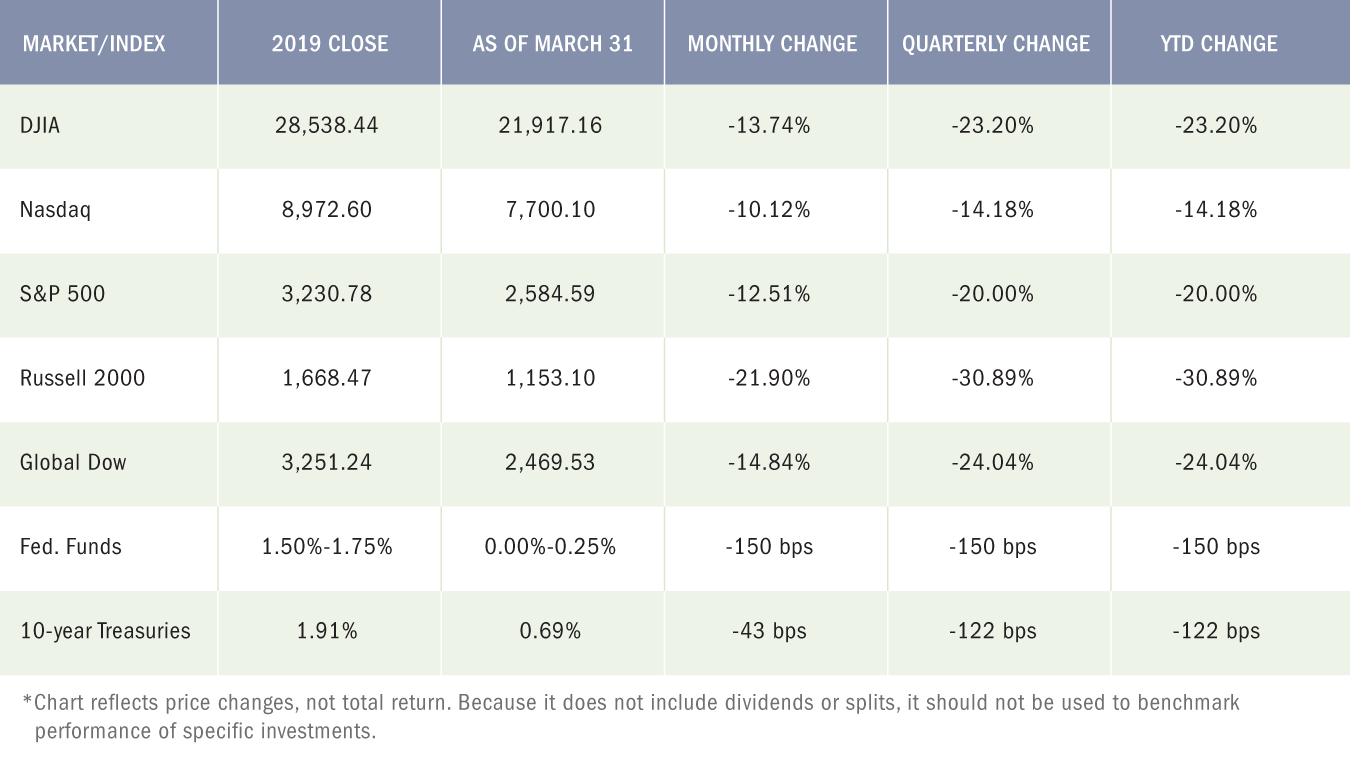

With such an interconnected economy, the net effect of “social distancing” initiatives represents the biggest disruption of economic activity since World War II. Economic activity has ground to a halt, shocking the world’s economies and creating panic in financial markets. Investor fears prompted a major sell-off in February and March, plunging stock prices well below their 2019 closing marks. There is no doubt that the economic toll will be massive, but at this point, it is still unclear, and difficult to measure the full extent of the damage.

For more detailed guidance and answers to frequently asked questions, FAQ’s, keep reading below.

Economic Stimulus of Historic Proportions

While the size and scope of this crisis are enormous, so too will be the governmental response. Congress has passed, and the President has signed, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the largest stimulus package in US history.

At a price tag of over $2 trillion, the CARES Act is a significant step toward cushioning the blow of this sudden economic crisis. The bill provides an assortment of loans and grants for both businesses and individuals. There are also funds for the healthcare sector, a loan program for small and medium-sized businesses, a cash pool for industry-specific needs (e.g. airlines), an expansion of unemployment insurance benefits, and—most controversially—direct cash payments to individuals in the form of direct deposits or checks in the mail. Please see below for additional details.

We believe this unprecedented economic stimulus package will surely help many individuals, businesses and large corporations survive this difficult period. Unfortunately, there will also be many that still suffer economically. With so much uncertainty regarding the duration of social distancing policies and the magnitude and length of the economic downturn, market volatility is likely to persist. Undoubtedly, unemployment numbers will continue to jump and both manufacturing and service-sector data will fall, but just how much will only start to become clear during this second quarter. The important questions are: how bad will it be, and how long will it last?

We do expect the second quarter will be the low point for the economy, and we should start to see a recovery in the second half of the year. As the second quarter unfolds there will be many negative economic headlines. In addition, a surge of COVID-19 cases is also widely expected. We must remind ourselves that much of what we are witnessing is now largely priced into markets—in other words, it is already expected. While the media will undoubtedly, and rightfully, focus on current events, we must look beyond the current headlines towards the future. China is showing signs of recovery already, and low-interest rates combined with stimulus should jump-start the economy when social distancing ends. We should not underestimate the power of these two forces, as we witnessed the impact these measures had on markets in 2009, following the 2008 financial crisis. The stimulus package this time around is more than double that of 2008.

As we look forward to hopeful developments, we know that the most important thing for all of us now is protecting our families and loved ones and staying healthy.

We hope you, your family and loved ones are healthy and safe during these unprecedented times.

John L. Diaz, CFP® | President & Senior Wealth Strategist | jd@yourpremierwealth.com

Coronavirus & The Markets FAQ

Guiding you through this period of uncertainty

We understand the constant negative headlines and extreme volatility in the financial markets is unnerving. In an effort to guide you through this uncertain period, we have compiled a list of key questions, answers, and insights that may be helpful.

What is happening in the markets?

Financial markets are attempting to price in a rapid and unprecedented shock to the world economy. The net result has been panic-selling and the fastest bear market in the history of equities. Markets around the globe have suffered their steepest falls since 2008. The fixed-income bond market has also experienced extreme selling, resulting in a loss of liquidity in segments of the corporate and municipal bond markets. This extreme activity prompted many to compare this period with the global financial crisis from 12 years ago.

While there are some similarities, the 2008 crisis was specific to the financial system itself and not a response to an external shock. While the economic impact from this pandemic will be very large, the economy and overall financial system today are in substantially better shape than they were in 2008. However, until we have more clarity on when we will have control of the spreading of this virus, as well as the financial impact, volatility in the markets will continue in both directions, down and up.

Why have the markets fallen by so much?

Investors hate uncertainty. This rapidly changing crisis is one of the most uncertain situations investors have ever faced. As a result, many investors panicked and rushed to deleverage and raise cash, selling assets such as equities, fixed income – bonds, and even gold. When selling is dictated by fear and panic, it tends to feed on itself and quickly becomes indiscriminate, without regard for value or fundamentals. The mentality becomes “sell now, ask questions later”. This increase in volatility can also trigger algorithmic (program) trading which further exacerbates the volatility.

We have experienced similar liquidity events like this in the past. Once again, 2008 comes to mind, but we have also had many others. When traders and investors all want to sell at the same time, with not that many buyers, it leads to large market swings, inefficient price discovery, and liquidity issues. This is especially felt in securities that don’t normally trade much volume. Such as segments of the corporate and municipal fixed income bond markets. For this reason, the Federal Reserve took several measures in March to increase liquidity and calm the markets. This included a massive $700 billion quantitative easing program as well as cutting the federal funds lending rate to zero. These measures are gradually helping to stabilize the markets.

What is the likely impact on global economic growth and the markets?

In order to properly answer that question, we need to know several facts. Firstly, will public health measures, especially the creation of effective vaccines, bring this pandemic under control within a few months? Secondly, how effective will the monetary and fiscal responses be from governments around the world? Clearly many economies will experience a short, sharp recession. How sharp will all be dependent on how long it takes to get control over this pandemic. We expect global growth to dramatically slow in the first two to three-quarters of 2020 and the data will get worse before it gets better. At this point, it is still very unclear what the full economic toll will be, as most economic data for March has yet to be released.

While the size and scope of this crisis are enormous, so too has been the governmental response to combat it. Congress passed, and the President signed, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the largest stimulus package in US history. At a price tag of over $2 trillion, the CARES Act is a significant step toward cushioning the blow of the sudden economic pause. The bill provides an assortment of loans and grants for both businesses and individuals. There are funds for the health care sector, a loan program for small and medium sides enterprises (SMEs), a cash pool for industry-specific needs (e.g., airlines), an expansion of unemployment insurance benefits, and most controversially, direct cash payments to individuals in the form of direct deposits or checks in the mail. This unprecedented stimulus should help to restart and boost the economy.

Could the crisis cause a more severe recession? What is the outlook?

Although the downturn is likely to be similar to a typical recession in many respects, it may be sufficiently brief to avoid significant debt defaults and job-shedding by companies. The uncertainty remains very high, however, and a deeper and more persistent recession is certainly possible. If the spread of the virus slows in the second quarter of the year, we expect a strong rebound in growth from the fourth quarter onward. This will be achieved with tremendous pent up demand once the economy restarts, coupled with the significant amount of stimulus support from the government and central bank.

What is PWA doing to manage/recover my investments?

As in past prolonged downturns, we believe tactical asset allocation and security selection are crucial. Certain asset classes, industry sectors, and companies will be particularly vulnerable to the effects of the pandemic. Whether because of high debt levels, exposure to travel and tourism, or a disruption to their supply chains. But not all markets, sectors and companies are equally exposed to those negative factors. We believe with active asset allocation, we may be able to concentrate on sectors or industries that are minimally affected.

It is also worth noting that in times of market panic, some investments are sold indiscriminately. In other words, the good has been punished along with the bad. This could create opportunities. In terms of equities, one obvious opportunity is the chance to invest in high-quality, resilient companies that have been caught up in indiscriminate selling.

The PWA Investment Policy Committee recently created the PWA Focus 25 Quality Equity strategy. This is an all-equity portfolio that focuses on quality companies with strong financials, across different industries, with business models that are sustainable in a difficult economic environment. It is interesting to note that there are many companies largely unaffected by the outbreak and some may even thrive, making market-share gains at the expense of competitors. Our goal is to give our clients exposure to the sectors and areas of the markets that we believe will excel in the future. For more information on this portfolio strategy, email John Diaz at jd@yourpremierwealth.com.

Is now the time to sell or withdraw my investments?

The first step in answering this question is to understand your investment time frame and liquidity needs over the next 1 to 3 years. If you have a short term need, then you should contact your advisor and discuss the best approach to fund that need. Generally speaking, however, given the very sharp drop in markets, we don’t believe that now is the time to be selling. Consider that the financial markets are a leading indicator of future economic activity. It is possible that the markets have already factored in much of the economic damage the coronavirus outbreak will do. As a result, investors who sell out now and realize losses, risk missing the potential future recovery.

Is now the time to add to my investments?

Although tactical flexibility is crucial, it’s important not to get sucked into attempting to time the market. Calling the bottom of a bear market is notoriously difficult. There is a famous investment saying, along the lines of “It is time in the market, not timing the market,” that matters. However, many investments are now on sale from where they were only a month ago. If you are investing for the future and have a longer-term time horizon, this could very well be a good opportunity to put money to work. If you are concerned about volatility, consider investing gradually and dollar-cost average in over a few weeks or months*.

What else should investors do now?

Now is a good time to review your investment strategy, rebalance your allocation, and make sure your portfolio is appropriately diversified. For your Non-Qualified accounts (not retirement) you can also consider tax swaps. This means that you take a tax loss on certain securities and reposition into other securities where there may be an opportunity to improve your investment strategy.

During this period of uncertainty, we at Premier Wealth Advisors aim to keep our clients fully updated on our thoughts and insights, and to answer any questions you might have. Below is the contact information for a few of our key advisors and contacts:

CARES Act Provides Relief to Individuals and Businesses

On Friday, March 27, 2020, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law. This $2 trillion emergency relief package is intended to assist individuals and businesses during the ongoing coronavirus pandemic and accompanying economic crisis. The following are highlights of many of the federal relief opportunities created thus far which may benefit you.

Tax Relief for Individuals:

- Extension of federal tax filing due date. The IRS postponed to July 15, 2020, the due date for both filing an income tax return and for making income tax payments originally due April 15, 2020. The postponement is automatic. Payments that may be postponed are limited to federal income tax payments in respect of a taxpayer’s 2019 taxable year and federal estimated income tax payments due on April 15, 2020, for a taxpayer’s 2020 taxable year. The extension is available to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate entities, including those who pay self-employment tax. As a result of the extension, any interest, penalty, or addition to tax for failure to file or pay tax will not begin to accrue until July 16, 2020

- IRA contribution deadline extended. The deadline for making 2019 IRA contributions has also been extended until July 15, 2020.

- HSA and MSA contribution deadlines extended. The deadline for making 2019 contributions to health savings accounts (HSAs) and Archer medical savings accounts (MSAs) has been extended until July 15, 2020.

Unemployment provisions

The legislation provides for:

- An additional $600 weekly benefit to those collecting unemployment benefits, through July 31, 2020

- An additional 13 weeks of federally funded unemployment benefits, through the end of 2020, for individuals who exhaust their state unemployment benefits

- Targeted federal reimbursement of state unemployment compensation designed to eliminate state one-week delays in providing benefits

- Unemployment benefits through 2020 for many who would not otherwise qualify, including independent contractors and part-time workers

Recovery rebates

Most individuals will receive a direct payment from the federal government. Technically a 2020 refundable income tax credit, the rebate amount will be calculated based on 2019 tax returns filed (2018 returns in cases where a 2019 return hasn’t been filed) and sent automatically via check or direct deposit to qualifying individuals. To qualify for a payment, individuals generally must have a Social Security number and must not qualify as the dependent of another individual.

The amount of the recovery rebate is $1,200 ($2,400 if married filing a joint return) plus $500 for each qualifying child under age 17. Recovery rebates are phased out for those with adjusted gross income (AGI) exceeding $75,000 ($150,000 if married filing a joint return, $112,500 for those filing as head of household). For those with AGI exceeding the threshold amount, the allowable rebate is reduced by $5 for every $100 in income over the threshold.

Rebate Amounts and Phaseout Ranges

While details are still being worked out, the IRS will be coordinating with other federal agencies to facilitate payment determination and distribution. For example, eligible individuals collecting Social Security benefits may not need to file a tax return in order to receive a payment.

Retirement plan provisions

- Required minimum distributions (RMDs) from employer-sponsored retirement plans and IRAs will not apply for the 2020 calendar year; this includes any 2019 RMDs that would otherwise have to be taken in 2020

- The 10% early-distribution penalty tax that would normally apply to distributions made prior to age 59½ (unless an exception applies) is waived for retirement plan distributions of up to $100,000 relating to the coronavirus; special re-contribution rules and income inclusion rules for tax purposes apply as well

- Limits on loans from employer-sponsored retirement plans are expanded, with repayment delays provided

Student loans

- The legislation provides a six-month automatic payment suspension for any student loan held by the federal government; this six-month period ends on September 30, 2020

- Under already existing rules, up to $5,250 in payments made by an employer under an educational assistance program could be excluded from an employee’s taxable income; this exclusion is expanded to include eligible student loan repayments an employer makes on an employee’s behalf before January 1, 2021

Business relief

- An employee retention tax credit is now available to employers significantly impacted by the crisis and is applied to offset Social Security payroll taxes; the credit is equal to 50% of qualified wages up to a certain maximum

- Employers may defer paying the employer portion of Social Security payroll taxes through the end of 2020 and may pay the deferred taxes over a two-year period of time; self-employed individuals are able to do the same

- Net operating loss rules expanded

- Deductibility of business interest expanded

- Provisions relating to specified Small Business Administration (SBA) loans increase the federal government guarantee to 100% and allow small businesses to borrow up to $10 million and defer payments for six months to one year; self-employed individuals, independent contractors, and sole proprietors may qualify for loans.

Click on the following link for an informative small business guide and checklist from the U.S. Chamber of Commerce: Corona Virus Emergency Loans Guide

Prior legislative relief provisions

Signed into law roughly two weeks prior to the CARES Act, the Families First Coronavirus Response Act (FFCRA) also included relief provisions worth noting:

- A requirement that health plans cover COVID-19 testing at no cost to the patient

- A requirement that employers with fewer than 500 employees generally must provide paid sick leave to employees affected by COVID-19 who meet certain criteria, and paid emergency family and medical leave in other circumstances

- Payroll tax credits allowed for required sick leave as well as family and medical leave paid

There is likely to be a steady stream of guidance forthcoming with details relating to many of these provisions, so stay tuned for more information. We’re here to help and to answer any questions you may have.

Key April Dates / Data Releases

4/1: PMI Manufacturing Index, ISM Manufacturing Index

4/2: International trade in goods and services

4/3: Employment situation, ISM Non-Manufacturing Index

4/7: JOLTS

4/9: Producer Price Index

4/10: Consumer Price Index, Treasury budget

4/14: Import and export prices

4/15: Retail sales, industrial production

4/16: Housing starts

4/21: Existing home sales

4/23: New home sales

4/24: Durable goods orders

4/28: International trade in goods

4/29: GDP, FOMC statement

4/30: Personal income and outlays

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. Market indices listed are unmanaged and are not available for direct investment.

All third-party materials are the responsibility of their respective authors, creators, and/or owners. First Allied is not responsible for third-party materials, and the information reflects the opinion of its authors, creators, and/or owners at the time of its issuance, which opinions and information are subject to change at any time without notice and without obligation of notification.

These materials were obtained from sources believed to be reliable and presented in good faith, nevertheless, First Allied has not independently verified the information contained therein, and does not guarantee its accuracy or completeness.

The information has no regard to the specific investment objectives, financial situation, or particular needs of any specific recipient, and is intended for informational purposes only and does not constitute a recommendation, or an offer, to buy or sell any securities or related financial instruments, nor is it intended to provide tax, legal or investment advice. We recommend that you procure financial and/or tax advice as to the implications (including tax) of investing in any of the companies mentioned.

PREMIER WEALTH ADVISORS

NEW YORK

1411 Broadway, 16th Floor

New York, NY 10018

(800) 499-4143

LONG ISLAND

626 RXR Plaza, 6th Floor

Uniondale, NY 11856

(516) 778-5822

All content on the Premier Wealth Advisors, LLC. websites are provided for informational purposes only and are deemed to be from reliable sources. However, no warranty, expressed or implied, is made regarding its presentation.

This content should not be viewed as a recommendation, offer, or solicitation by PWA to buy, sell, or hold any security or financial product, nor does it endorse any specific investment strategy. Past performance does not guarantee future results, and all investments carry the potential for loss.

PWA manages portfolios based on each client’s specific investment needs, as specified in a signed investment advisory agreement. As a result, each client’s portfolio reflects unique circumstances and investment outcomes. PWA’s outlook and strategies may change based on updated client information, or if material or significant shifts in economic and financial market conditions occur.

While PWA aims to add value in areas beyond investments, such as tax and estate planning, we do not claim to be income tax professionals or estate planning attorneys. You should consult your tax advisor and/or estate planning attorney for legal or accounting needs.

Advisory Services are offered through Premier Wealth Advisors, LLC. an SEC Registered Investment Adviser.